Glossary

Key terms for net-net investing.

-

At-The-Market (ATM) Facility

-

Borrow Fee / Short Rate

-

Catalyst

-

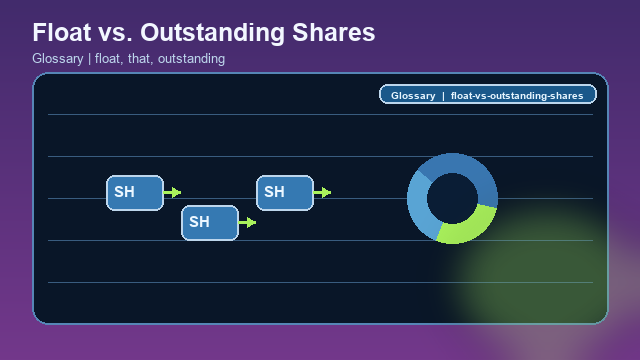

Float vs. Outstanding Shares

-

Floorless Convertible

-

Going-Concern Warning

-

Net-Net Portfolio Rule

-

Net-Net Working Capital (NNWC)

-

Reverse Split

-

Tender Offer

-

Circle of Competence

-

Defensive Investor

-

Enterprising Investor

-

Market Analysis

-

Mr. Market

-

Security Analysis

-

Special Situation

-

Cost of Capital

-

Depreciation vs. Amortization

-

Earning Power

-

Margin of Safety

-

Net Current Asset Value (NCAV) Per Share

-

Net Current Asset Value (NCAV)

-

Net Tangible Asset Value (NTAV)

-

Non-Cash Charges